About Matt

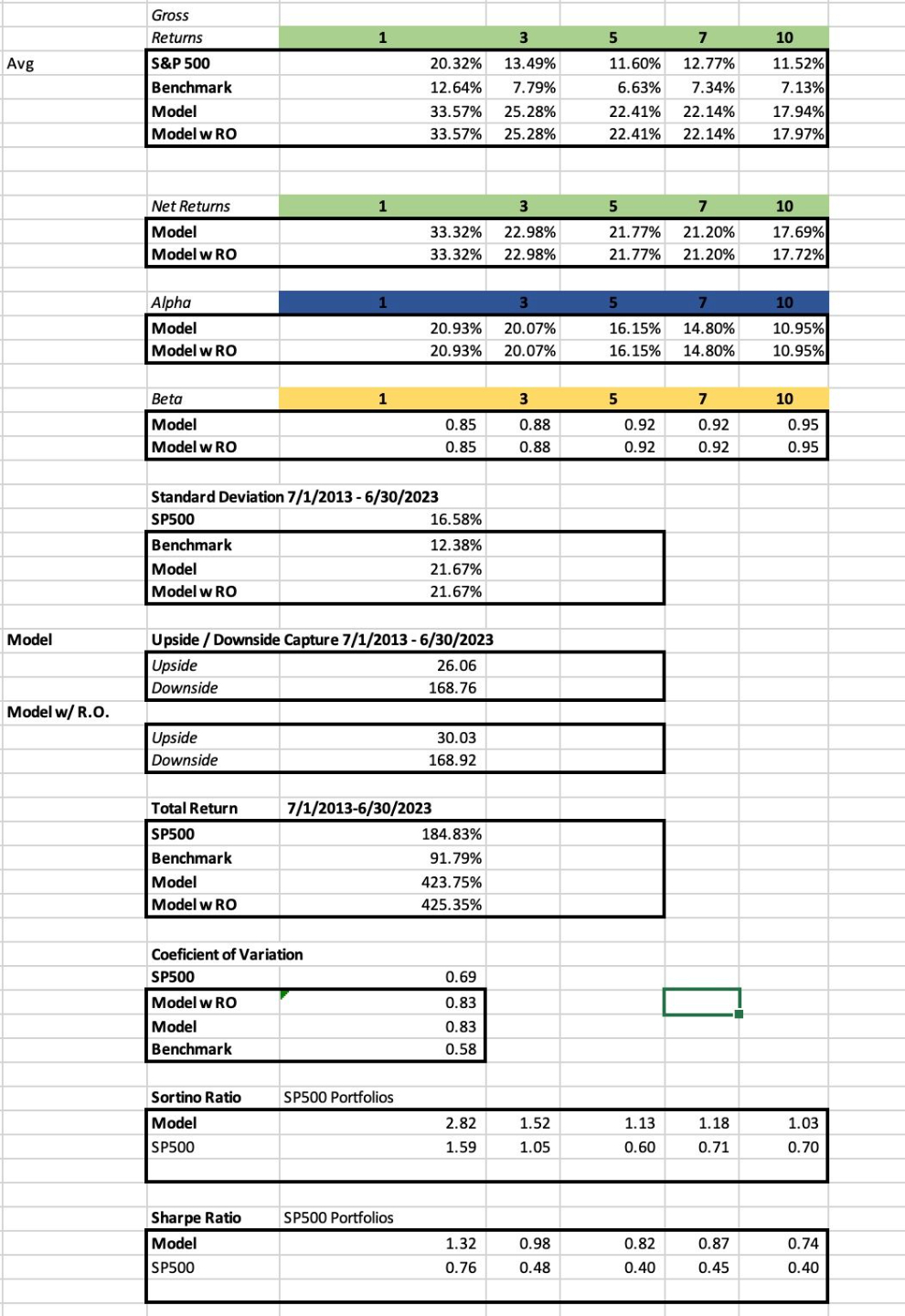

Matt is a finance PhD (University of New Orleans, 2019) and professor. He builds models that track best performing stocks based on fundamental and technical properties that show the strongest fundamental and momentum properties with a proven track record of out performance. He builds university classes that meet the students at their level and brings them through the material through learning by doing.

The site is an education platform that shows portfolio strategies that outperform the market historically, recession signals, day-trading strategies, investment courses and financial modeling courses. Key takeaways are:

- 15 years of research experience and building models that outperform the market.

- Applications that show the models continue to outperform in real time after publication.

- Data used with point-in-time survivor-bias free estimates from the Center for Research in Security Prices (CRSP) and Fact Set via Portfolio123.com.